Market Recap

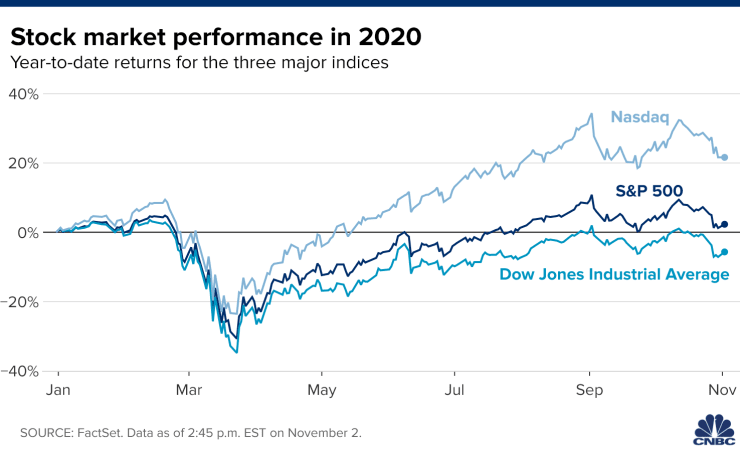

US Markets:

After October ended with significant volatility and losses, stocks began November by significantly recovering some of the sharp losses from last week. Last week marked the 11th time this year that the S&P ended the week over 2% lower than the start of the week, compared with a yearly average of around six times since 2010. Markets also experienced their worst weekly losses since the infamous March crash, and the VIX hit its highest figure since June. Today, however, The Dow Jones closed 422 points higher, or 0.6%, while The S&P 500 gained 1.2%, and The Nasdaq rose 0.4%.

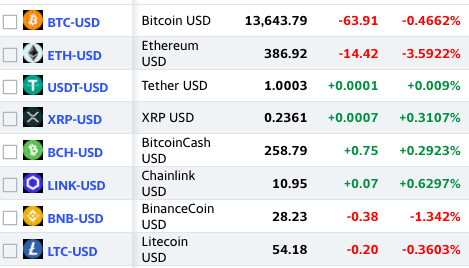

Cryptocurrency:

Bitcoin’s price marginally dropped, while Ethereum dropped by nearly 3.6%. Bitcoin has been on quite a tear as of late reaching $14,000 2 days ago for the first time since early 2018. While Bitcoin cooled off somewhat today, the upside is still there, as bullish investors see it as a safe haven from financial uncertainty nowadays. Additionally, major payment processors have been increasingly warming up to Bitcoin, with Square buying $50 million in bitcoin and PayPal now offering cryptocurrency transactions on its platform.

Overall Market:

After markets were crushed the last two weeks, all three major indices closed firmly in the green today. However, the sentiment is still tense at best due to three major catalysts:

COVID 19

COVID 19 continues to surge to record numbers in parts of the US and Europe. Although economic data has been showing encouraging signs of recovery, the current surge in COVID cases threatens to completely derail all progress. France and Germany reimposed lockdown measures, and the UK over the weekend announced a month-long lockdown. Lockdowns are obviously not sustainable or conducive to economic growth, and markets know this.

Stimulus

There is significant pessimism on a second stimulus package. Investors were cautiously optimistic at one point that a stimulus package would pass before the election. Now, however, investors truly do not believe that one will pass until 2021. Until much-needed economic relief reaches American families and businesses, volatility and muted gains are to be expected.

Election

According to CNBC’s Jim Cramer, Monday’s gains were possibly driven by easing concerns over a delayed or contested election. However, nothing can be ruled out in the future, and there is a certain fear of the unknown. Historically, markets do not like contested elections. According to research done by Deutsche Bank, previously contested elections (2000, 1876, and 1824) showed bouts of volatility and a flight toward safer assets like US debt. Until everyone has some clarity on the US election, everything is still uncertain and in a holding pattern.

WHATS UP

At the market’s close, Joe Biden held a substantial 52%-42% national lead over President Donald Trump. Investors betting on a Biden win increased positions in solar stocks, with The Invesco Solar ETF (TAN) rising 3.2%.

Honeywell and Walgreens Boots Alliance were the best-performing Dow stocks, gaining more than 5% each. The S&P 500 was also led higher by gains in the energy, materials, and industrials. Energy and materials each gained at least 3.4% while industrials gained 2.7%. Big Tech, however, continued its losses from last week as Facebook and Amazon dipped 0.7% and 1%, respectively.