Market Recap

US Markets:

Markets continued yesterday’s gains, as investors seemed relieved that election day was finally here and optimistic that we will know a winner sooner rather than later. Historically, markets do not like contested elections. If the markets the last two days showed us anything, it’s that investors believe that a delayed or contested result will be avoided.

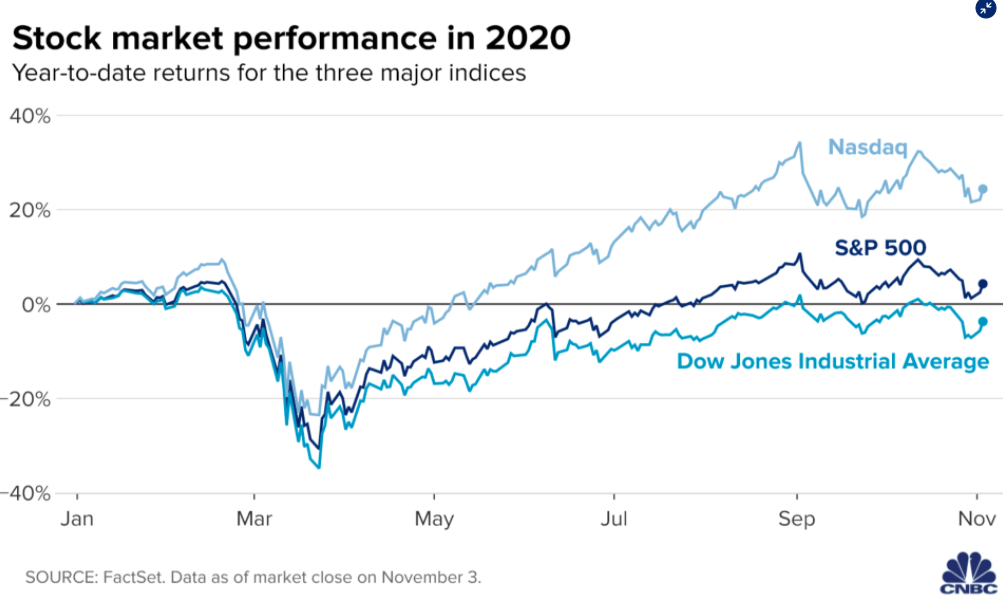

The Dow Jones closed 554.98 points higher, or 2.1%, at 27,480.03. The Dow briefly traded over 700 points higher during the session’s final minutes, before pulling back slightly at the close. The S&P 500 also gained 1.8%- good for the second-best election day performance in the index’s history. The tech-heavy Nasdaq index also gained 1.9%.

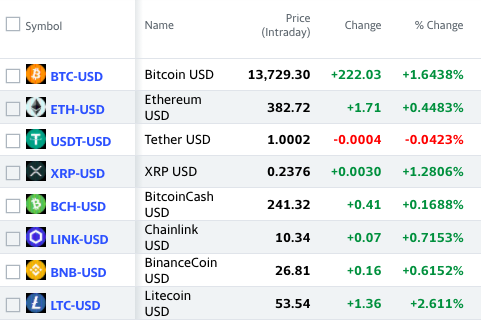

Cryptocurrency:

It was a good day overall for cryptocurrencies as Bitcoin recovered all of its marginal losses from yesterday. Ethereum was slightly up as well after dropping by nearly 3.6% yesterday. All other cryptocurrencies were also up across the board, with the exception of Tether that traded relatively flat. Bitcoin continues its march back towards $14,000 after reaching the level 3 days ago for the first time since early 2018. Bullish investors continue to see Bitcoin as a safe haven from financial uncertainty, and as a growth instrument as major payment processors continue to embrace the cryptocurrency.

Overall Market:

After markets were crushed the last two weeks, all three major indices closed sharply higher for the second consecutive day. However, the sentiment is still tense at best due to three major catalysts:

COVID 19

COVID 19 continues to surge to record numbers in parts of the US and Europe. Although economic data has been showing encouraging signs of recovery, the current surge in COVID cases threatens to bring countries back to square one. France and Germany reimposed lockdown measures, and the UK over the weekend announced a month-long lockdown. There are fears that the lockdowns could last until after Christmas. Lockdowns are obviously not conducive to economic growth, and markets know this.

Stimulus

There is significant pessimism on a second stimulus package passing until 2021. Until much-needed economic relief reaches American families and businesses, volatility and muted gains are to be expected.

Election

Gains the last two days were largely driven by easing concerns over a delayed or contested election. But nothing can be ruled out in the year 2020. Markets historically do not like contested elections. According to research done by Deutsche Bank, previously contested elections (2000, 1876, and 1824) showed bouts of volatility and a flight toward safer assets like US debt. Until there is clarity on the US election, anything is possible.

WHATS UP

In the final pre-election poll, former Vice President Joe Biden maintained his lead in national polling over the incumbent President Donald Trump at 52% to 42%. Polls predictably were way closer in swing states.

Investors have been taking note of positive economic data, as yesterday’s strong ISM manufacturing report built on the strong GDP report released last week, and the improving jobless claims. Investors are also anxiously awaiting earnings reports this week from companies such as PayPal, Qualcomm, Alibaba, T-Mobile, Square, Uber, and CVS. Investors are also eagerly anticipating the FOMC announcement on Thursday, and the October jobs report on Friday.

Walgreens Boots Alliance led the Dow for the second day in a row gaining more than 4%. JPMorgan Chase and Goldman Sachs also contributed to the Dow’s gains, rising 3.4% and 4.1%, respectively. Industrials and financials were also the best-performing sectors in the S&P 500, gaining more than 2% each.

Sources: CNBC.com, Yahoo! Finance