Market Recap

US Markets:

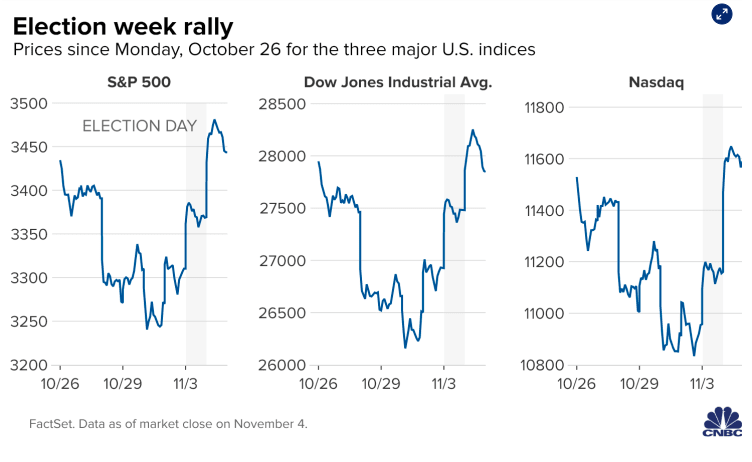

Although there is no clear-cut election winner yet, the markets overlooked this and gained for the third day in a row.

The Dow Jones jumped 367.63 points, or 1.3%, to 27,847.66. The index surged to session highs of over 800 points before pulling back at the close. The S&P 500 rose 2.2% after gaining as much as 3.5% earlier in the day, and the tech-heavy Nasdaq popped 3.9%.

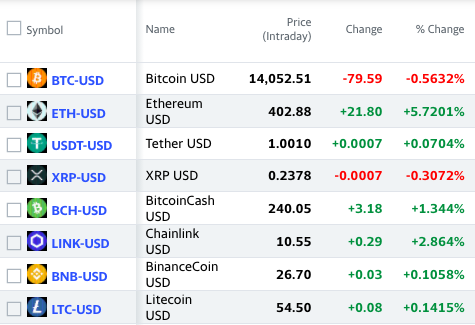

Cryptocurrency:

Cryptocurrencies had another strong day as Bitcoin briefly reached a 3-year high of $14,236. This is the highest price that Bitcoin has traded at since early-January 2018. After Wyoming’s Republican Senate candidate Cynthia Lummis won her election, the cryptocurrency surged. This is because Lummis is an early Bitcoin adopter and a big fan of the cryptocurrency. Lummis invested in Bitcoin in 2013, and has gone on record saying that she believes bitcoin’s limited supply makes it an attractive store of value. Ethereum also popped over 5% today, and Chainlink gained over 2.5%.

Overall Market:

After markets were crushed the last two weeks, all three major indices closed sharply higher for the third consecutive day.

European stocks moved higher today as well, with the German DAX rising 2% and all other major indices gaining between 0.5% to and 2.4%.

Investors across the world continued to anxiously monitor the US presidential election with ballots still left to be counted. Although Biden is leading with 264 electoral votes to Trump’s 214 votes and is seemingly in arms reach of the presidency, there is still no conclusive winner. Although the election is not formally contested yet, this is a very real possibility that could have devastating consequences for the market. Markets historically do not like contested elections. According to research done by Deutsche Bank, previously contested elections (2000, 1876, and 1824) showed bouts of volatility and a flight toward safer assets like US debt. Until there is clarity on the US election, anything is possible.

No final election result could further delay a second stimulus package as well. Markets simply will not sustain this rally until much-needed economic relief reaches American families and businesses.

WHATS UP

Although the election is garnering the majority of the attention, investors are also eagerly anticipating the FOMC announcement tomorrow, and the October jobs report on Friday. These are typically market-moving events, so make sure to pay attention.

Big Tech companies led the gains today. Apple and Microsoft each rose at least 4%, while Facebook popped 8.3%, and Alphabet and Amazon both jumped more than 6%.

A number of factors caused Big Tech to pop today. For one, these stocks offer consistent returns and safety in times of uncertainty. Additionally, many investors viewed the potential for Republicans to hold onto the Senate as a positive for the sector. If the Democrats took over the Senate, many feared that this would lead to higher capital gains taxes- something that would surely weigh on high-growth stocks.

Sources: CNBC.com, Yahoo! Finance, TradingEconomics