Market Recap

US Markets:

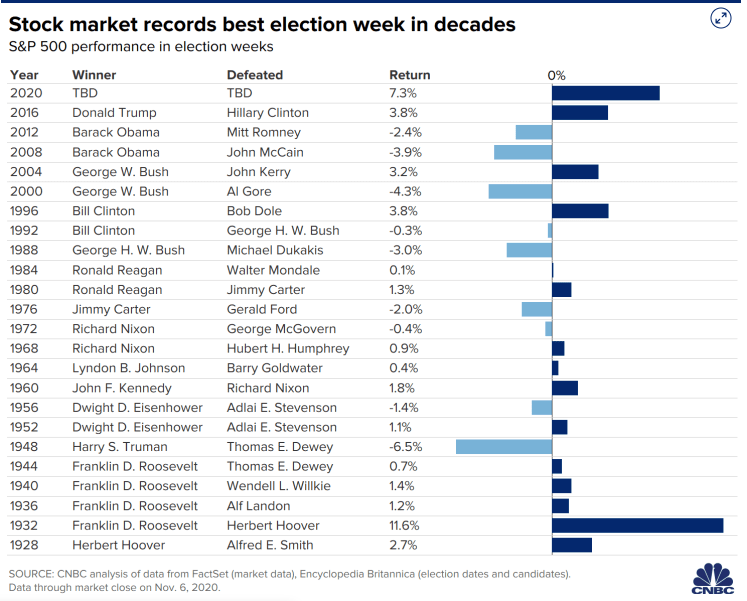

Even with the election undecided, markets closed with their best weekly gains since April. However, the end may be near as Joe Biden closes in on the 270 electoral votes needed to win the presidency.

Stocks cooled off from their scorching rally this week and ended Friday mostly flat. The Dow Jones dipped 66.78 points, or 0.2%, while the S&P closed down .03% and the Nasdaq gained .04%.

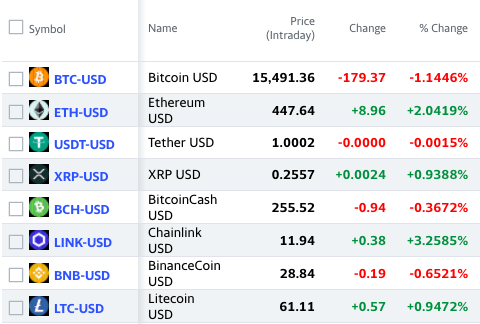

Cryptocurrency:

Cryptocurrencies did not move much today. Bitcoin fell mildly today, however, the cryptocurrency is still up 30% for the month and is at its highest level since January 2018. Bitcoin is still above that $15,000 level and bullish investors are encouraged that it could soon hit break $20,000 and hit an all-time high. Ethereum also moved upwards today gaining over 2%, while Chainlink was the best performing cryptocurrency gaining over 3.25%.

Overall Market:

Although U.S. stocks were flat on the day, this is still their best performing week since April. The Dow rose 6.9% this week, while the S&P 500 and Nasdaq jumped 7.3% and 9%, respectively. As seen in the above table, this has been the S&P 500’s biggest election week gain since 1932.

European stocks also saw their best week since June and rallied 7% for the week. Frankfurt’s DAX 30 led European markets gaining 8% for the week despite dropping .07% on Friday.

Gold also saw its best week since July moving 0.2% higher on Friday and 4% for the week. Gold is now trading at $1952.3 an ounce, its highest level in nearly two months. Yesterday’s announcement by the Federal Reserve leaving interest rates at ultra-low rates also leaves room for further upside momentum. While gold rose this week, the dollar continued to weaken amid increasing chances of a divided US Congress. While some investors like the idea of a divided Congress, this makes the passage of a large stimulus package less likely.

WHATS UP

Although the election is garnering the majority of the attention, the October jobs report released today brought in stronger numbers than expected. The unemployment rate fell to 6.9% in October from 7.9%, crushing consensus estimates of 7.7%. 638,000 jobs were also added in October easily beating the Dow Jones estimate of 530,000.

Energy and financials were the worst-performing sectors in the S&P 500 today, falling 2.1% and 0.8%, respectively. UnitedHealth also led the Dow lower with a decline of nearly 2%.

Sources: CNBC.com, Yahoo! Finance, TradingEconomics, Wall Street Journal