Market Recap

US Markets:

Strong gains to open the week were anticipated after Joe Biden was officially declared President-elect over the weekend. However, what truly sent markets skyrocketing today was trial data from drugmakers Pfizer and BioNTech indicating their Covid-19 vaccine is more than 90% effective. This crushed anyone’s estimates and sent stocks skyrocketing to all-time highs.

Investors also cheered the Biden win, and believe it is a sign of a calmer and more stable America. Investors are also encouraged that Republicans will likely keep control of the Senate making it harder for the Biden administration to raise taxes and regulate businesses.

The Dow Jones closed 834 points higher, or 2.95%, for its biggest one-day gain since June 5. Additionally, The Dow hit an all-time high earlier in the session, surging over 1,600 points or 5.7%. This is the first intraday all-time high that The Dow hit since February. The S&P 500 also gained 1.2% and reached an intraday all-time high. The small-cap Russell 2000 gained 3.7% as well. The Nasdaq, however, lagged and closed down 1.5% as investors rotated out of high-flying “stay-at-home” tech names and into cyclical value stocks.

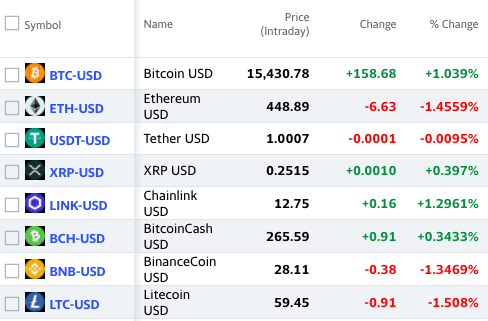

Cryptocurrency:

Despite the surge of the overall market, cryptocurrencies did not move much today. Bitcoin gained mildly and is up 30%. Bitcoin also remains above that $15,000 level and remains at its highest level since January 2018. Bullish investors are encouraged that it could soon hit break $20,000 and hit an all-time high. Ethereum dropped about 1.45%, while none of the other cryptos made significant moves.

Overall Market:

Markets globally cheered the vaccine news. For the first time, investors see a light at the end of the tunnel, and a sign that the pharmaceutical industry may soon control this dreaded pandemic.

The 90% effective rate from Pfizer and Germany’s BioNTech was also considerably better than what the market anticipated. Dr. Anthony Fauci, director of the National Institute of Allergy and Infectious Diseases, once claimed that a vaccine that was 50% to 60% effective would be acceptable.

While the Dow Jones and the S&P 500 came close to hitting record highs, European markets closed up more than 5%, while Asian markets gained too. Foreign markets also cheered the Biden win as a sign of a more stable and calm America.

While markets surged, Gold posted its worst day since August, falling more than 5% to as low as $1,850 an ounce. Fading stimulus hopes also contributed to the decline. The US 10-Year Treasury Yield also reached its highest level since March, and rose by 13bps to 0.96%. The yield on the 30-year Treasury bond also climbed 11 basis points to 1.71%

WHATS UP

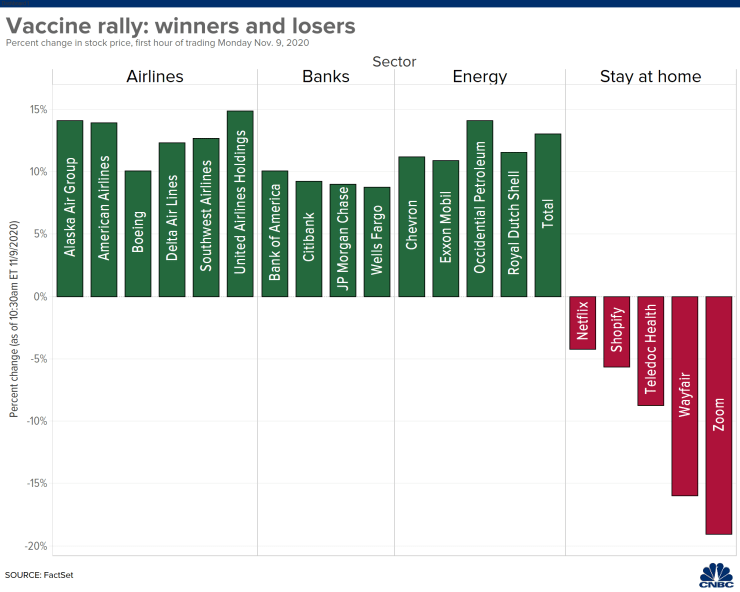

The theme of the day was the recovery stock. The biggest winners today were the stocks most severely hampered by COVID-19, while the biggest losers were the “stay-at-home” darlings of 2020.

Travel, restaurant, energy, and hospitality companies that were crushed during the initial wave of COVID, were some of the biggest winners on Monday following Pfizer’s announcement.

Shares of cruise-operator Carnival Corp. skyrocketed by 39.3%, Southwest Airlines jumped 9.7%, Disney popped 11.9%, and Valero surged 31.2%.

Bank stocks also rallied. JPMorgan Chase and Bank of America gained 13.5% and 14.2%, respectively, while Citigroup advanced 11.5%.

It was not a good day for the “stay-at-home” stocks though. Zoom dropped 17.4% lower, Amazon slid 5.1%, Netflix dipped 8.6%, telemedicine company Teladoc dropped 13.7%, and Peloton dropped by 20.29%.

Source: CNBC, TradingEconomics, Yahoo! Finance