Market Recap

US Markets:

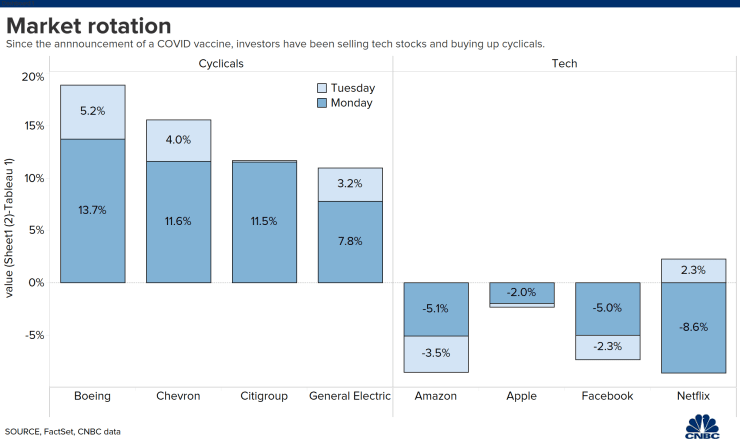

The Dow Jones built on yesterday’s sharp gains as a market rotation out of “stay-at-home” hot tech names into beaten-down value stocks linked to recovery continued.

The Dow jumped 262.95 points, or 0.9%, to close at 29,420.92, while both the S&P 500 and Nasdaq lagged as tech names struggled for the second day in a row. The S&P 500 closed 0.1% lower at 3,545.53 and the Nasdaq slid 1.4% to 11,553.86.

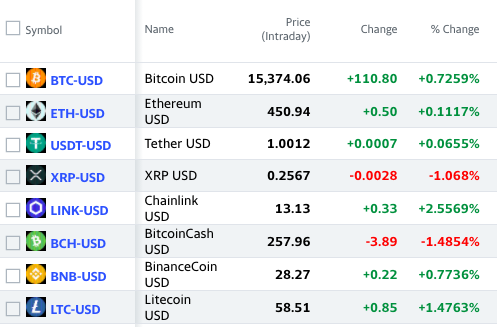

Cryptocurrency:

Cryptocurrencies did not move much again today. Bitcoin remains up 30% for the month and continues to hover above $15,000. The cryptocurrency has not traded this high since January 2018, and bullish are encouraged that it could inevitably break the $20,000 mark and approach an all-time high. Ethereum did not move much either today, while Chainlink led the cryptos rising by over 2.5%.

Overall Market:

Global markets continued yesterday’s surge. European stocks closed at an over 8-month high following news that European Parliament and EU governments reached a deal on the EU’s budget and recovery plan. In addition, there was renewed Brexit optimism and the continuous euphoric sentiment from the COVID-19 vaccine data. The Mexican IPC index also reached a 7-month high, as the Canadian TSX and Brazilian Ipovespa also gained.

WTI crude futures also rose by more than 2% to trade around $41.1 a barrel and close to an over two-week high. Comments from Saudi Arabia’s energy minister also supported prices after he stated that OPEC+ could adjust their supply cut pact if demand slumps before a vaccine is available. The rise in crude prices can also be attributed to positive vaccine news. Corn futures also skyrocketed to a 15-month high of $4.27 per bushel in November, almost doubling its value from a 4-year low of $3.08 per bushel in August. The strong pace of export sales to China and adverse weather before and during harvest contributed to the rise in price.

WHATS UP

The theme of the day once again was the recovery stock. The biggest winners for the second day in a row were the stocks most severely hampered by COVID-19, while the biggest losers were the “stay-at-home” COVID winners.

Amazon shares fell 3.5% after falling 5% yesterday. Zoom Video dropped another 9%, adding to its 17% decline from Monday. Alphabet and Microsoft also lost 1.4% and 3.4%, respectively.

Economic recovery names rose yet again on Tuesday. Oil giants Chevron and Exxon Mobil climbed 4.6% and 2.2%, respectively, while Boeing closed another 5.2% higher.

Source: CNBC, TradingEconomics, Yahoo! Finance